ISRAEL – Israeli cellular agriculture firm Pluri has secured a US$6.5M investment and is set to acquire a majority stake in Rehovot-based Kokomodo, a company specializing in cell-cultured cocoa.

The move marks Pluri’s expansion into the cultivated chocolate space, following its ventures in lab-grown meat and coffee.

Pluri, headquartered in Haifa, will acquire at least 71% of Kokomodo for US$4.5 million from Chutzpah Holdings and Plantae, both controlled by health and technology investor Alejandro Weinstein.

Alongside the acquisition, Weinstein is investing US$6.5 million into Pluri, a deal expected to close by the end of this month, pending regulatory approvals.

Strategic growth and innovation

Pluri, listed on the Tel Aviv Stock Exchange (TASE) and Nasdaq, originally focused on stem cell therapy for disease treatment.

In recent years, it has expanded into food and manufacturing, establishing cultivated meat startup Ever After Foods in partnership with food giant Tnuva in 2022.

The company has also ventured into cell-based coffee under its PluriAgTech vertical, which led to the launch of its subsidiary, Coffeesai, targeting regulatory approval from the U.S. Food and Drug Administration (FDA) via the Generally Recognized as Safe (GRAS) pathway.

The investment from Weinstein is expected to strengthen Pluri’s financial position and fuel innovation across its cell-based technology platform.

“We believe that Mr. Weinstein’s equity investment will strengthen our financial foundation and allow us to advance our entry into the cultivated cacao market, positioning Pluri as a leader in this sector,” Pluri CEO Yaky Yanay emphasized the strategic importance of the deal.

Kokomodo’s role in sustainable chocolate production

Kokomodo emerged from stealth mode last year after securing a US$750,000 investment from The Kitchen FoodTech Hub and the Israeli Innovation Authority.

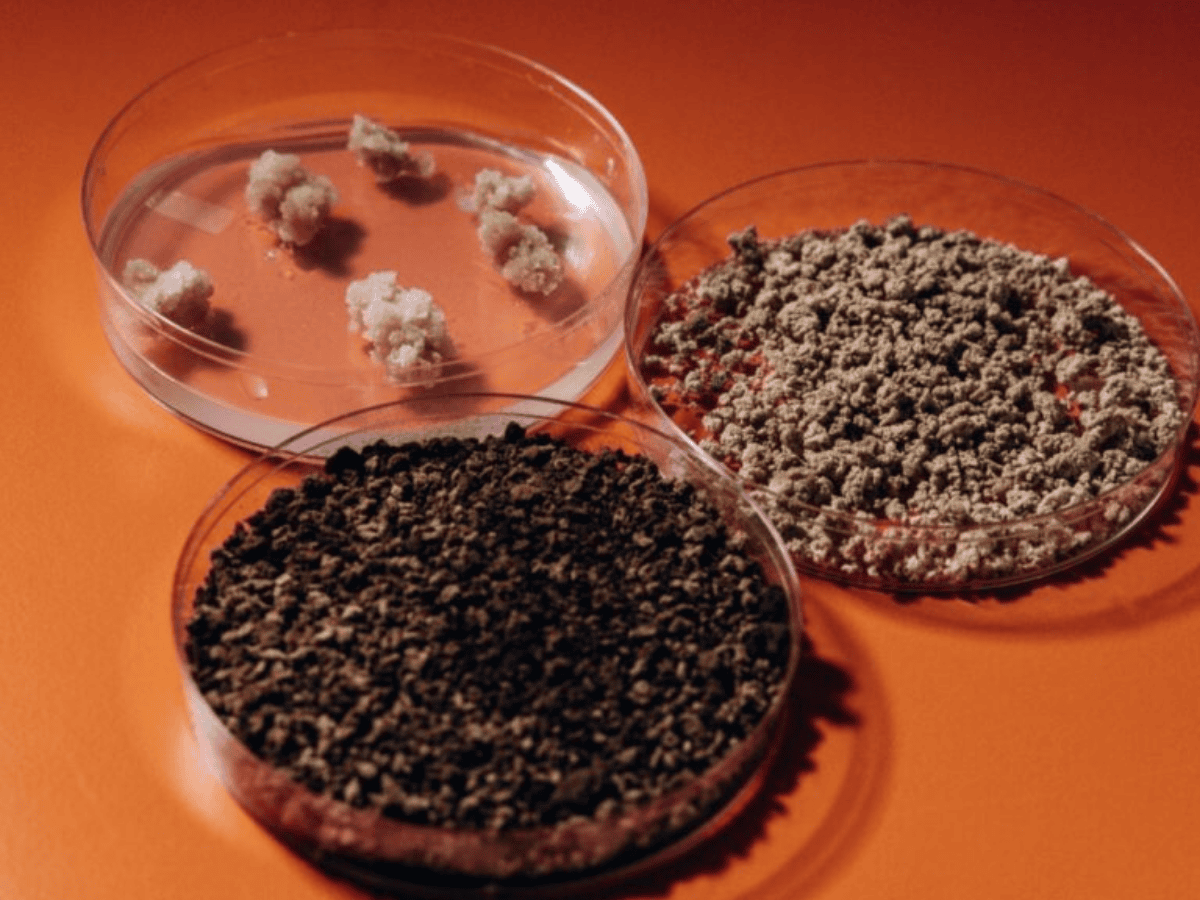

The startup uses cellular agriculture technology to produce cocoa, utilizing cells from premium cocoa beans sourced from Central and South America.

Having successfully completed lab-scale production, Kokomodo aims to reach price parity with conventional chocolate and is considering a U.S. market launch.

With the impending acquisition—expected to finalize in Q2—Pluri aims to expand Kokomodo’s operations and capitalize on the rising demand for sustainable food technologies. The deal will also enhance Pluri’s strategic and operational capabilities.

“The synergy between Kokomodo’s advancements in cell line development and Pluri’s industrial-scale production creates a strong foundation for innovation,” Yanay noted.

“This positions the company to lead the field of cultivated cacao and set new benchmarks in the sector.”

Addressing chocolate’s environmental challenges

The US$120 billion chocolate industry has significant environmental implications, with cocoa farming linked to extensive deforestation and high water consumption.

A single chocolate bar requires approximately 1,700 liters of water, while cocoa-driven deforestation accounts for 94% and 80% of land clearing in Ghana and Ivory Coast, respectively.

Additionally, dark chocolate ranks among the most polluting foods, second only to beef in terms of carbon footprint.

Climate change is further exacerbating challenges in cocoa production, driving up prices and reducing global stock levels.

Cocoa prices tripled last year, reaching record highs, while global reserves fell to historic lows. If current trends persist, experts warn that a third of the world’s cocoa trees could be lost by 2050.

Kokomodo is among a growing number of companies seeking to future-proof the chocolate industry through cellular agriculture.

Other players in the space include Swiss startup Food Brewer, U.S.-based California Cultured, and Israeli firm Celleste Bio.

Meanwhile, companies such as Voyage Foods (U.S.), Planet A Foods (Germany), Win-Win (UK), and Foreverland (Italy) are developing cocoa-free chocolate alternatives.

Financial and regulatory details

As part of the investment deal, Pluri is issuing 1,383,948 common shares at a purchase price of US$4.61 per share to Weinstein’s investment entity.

The agreement also includes warrants to purchase 84,599 additional shares at an exercise price of US$5.568 per share, along with pre-funded warrants for 26,030 shares at an exercise price of US$0.0001 per share.

The total proceeds of US$6.5 million will be used for working capital and general corporate purposes.

Weinstein will join Pluri’s board of directors upon closing, maintaining his seat as long as he holds at least 10% of the company’s common shares.

The investment and Kokomodo transaction are subject to shareholder approvals from Pluri, the European Investment Bank, Nasdaq, and TASE. Both deals are expected to close by the end of Q1 2024.