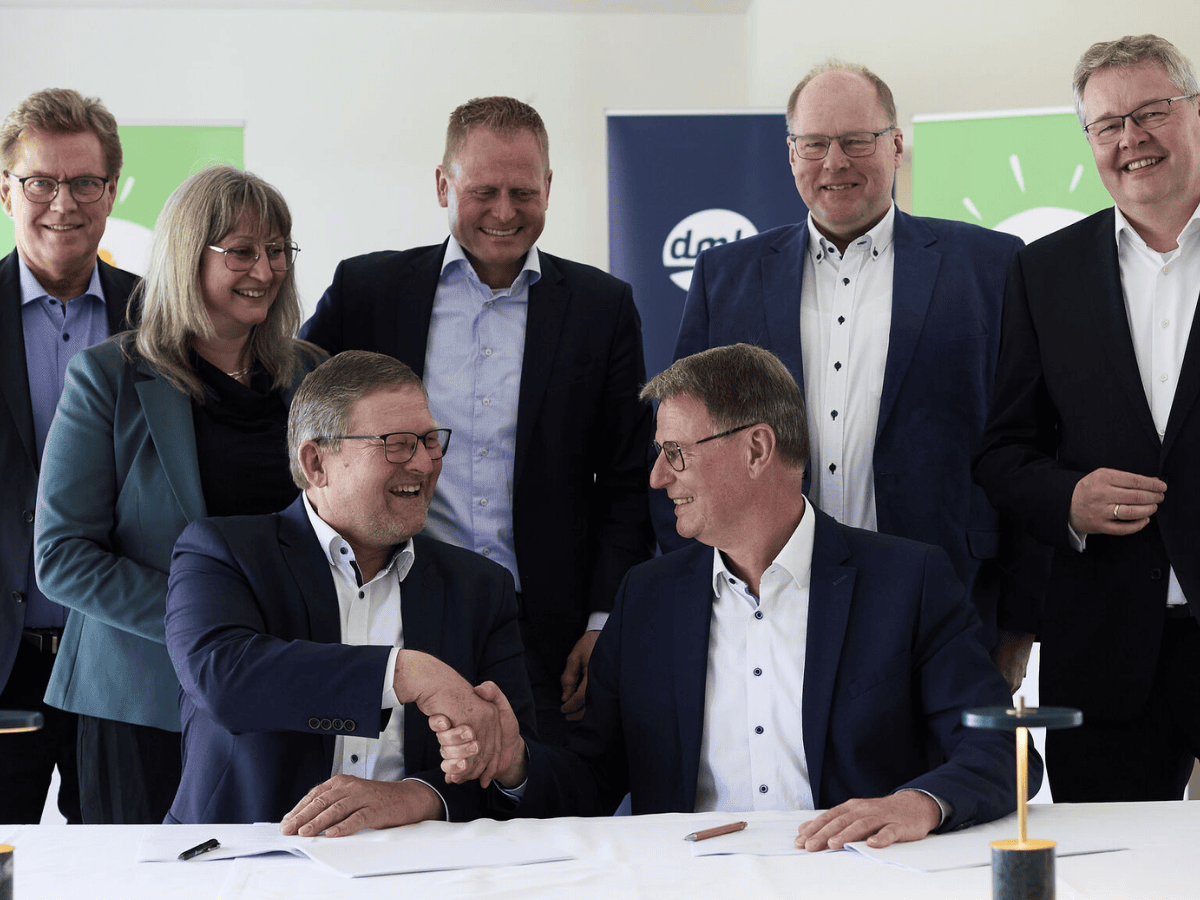

EUROPE – Arla Foods and Germany’s DMK Group have announced a proposed merger that, if approved, would form Europe’s largest dairy cooperative.

The combined business will include more than 12,000 farmer-owners and is expected to reach a pro forma annual revenue of approximately €19 billion (US$20.5B), based on the most recent available financial data.

The announcement marks a potential consolidation of two of Europe’s most influential farmer-owned cooperatives in a move intended to streamline operations, bolster milk supply stability, and expand the reach of dairy products globally.

Both Arla and DMK have cited a shared commitment to product quality and long-standing cooperative values as the foundation for the merger proposal.

Pending approval from the cooperatives’ respective Boards of Representatives and regulatory authorities, the merged entity will operate under the Arla name, with headquarters based in Viby J, Denmark.

The proposed management structure names Jan Toft Nørgaard as Chair and current Arla CEO Peder Tuborgh continuing in his role. DMK’s CEO Ingo Müller is set to join Arla’s executive management team as Executive Vice President of post-merger integration.

The merger process involves a detailed proposal that will be reviewed by cooperative members, employee representatives, and Works Councils in the coming months.

A formal vote by the Boards of Representatives in both cooperatives is scheduled for 17th and 18th June 2025. Regulatory assessments are expected to continue through to the end of 2025.

The unified cooperative will bring together complementary business segments and product portfolios across private label, branded, and ingredients categories.

Arla Foods, which posted a 2023 revenue of €13.8 billion (US$14.9B), operates across Denmark, Sweden, the UK, Germany, Belgium, Luxembourg, and the Netherlands.

Its product portfolio includes globally distributed brands such as Arla, Lurpak, Castello, and Puck, and the company is recognized as the world’s largest producer of organic dairy products.

DMK Group, Germany’s largest dairy cooperative, recorded €5.1 billion (US$5.5B) in revenue. Its operations include over 20 locations in Germany and the Netherlands, producing cheese, milk-based foods, baby food, vegan offerings, and ingredients.

DMK’s consumer-facing brands include MILRAM, Oldenburger, Uniekaas, Alete bewusst, and Humana.

The two cooperatives have previously collaborated on joint initiatives, including the ArNoCo joint venture, which processes whey from DMK’s cheese production into high-value whey protein concentrate and lactose for Arla’s ingredients business.

Speaking on the proposal, Jan Toft Nørgaard said the move builds on years of partnership and aims to ensure long-term resilience for both cooperatives’ members.

Arla CEO Peder Tuborgh noted the merger aligns with Arla’s goal of maintaining consistent dairy production while accessing new consumer markets. Ingo Müller, CEO of DMK Group, added that the proposed deal provides an expanded platform for innovation and a broader customer base.

The merged cooperative will manage a combined milk volume of 19 billion kilograms annually. Arla currently processes 13.7 billion kg of milk from its 7,600 farmer-owners, supported by 21,900 employees. DMK contributes 5.3 billion kg from its 4,600 members and employs 6,800 people.

As part of the transition, both companies are expected to review operational synergies, brand positioning, and integration pathways in a bid to remain competitive amid shifting market dynamics and a forecasted decline in the European milk pool.

This development follows a broader trend of consolidation in the global dairy industry. In recent years, cooperatives and private processors have sought partnerships to address market volatility, supply chain pressures, and changing consumer preferences, particularly around plant-based alternatives and nutritional demands.

If approved, the proposed Arla-DMK merger would reshape the landscape of Europe’s dairy sector, with implications for retail partnerships, ingredient supply chains, and farmer remuneration models across multiple countries.

More information will be shared following the June vote by the Boards of Representatives.